Award-winning PDF software

Form 12333 online Kentucky: What You Should Know

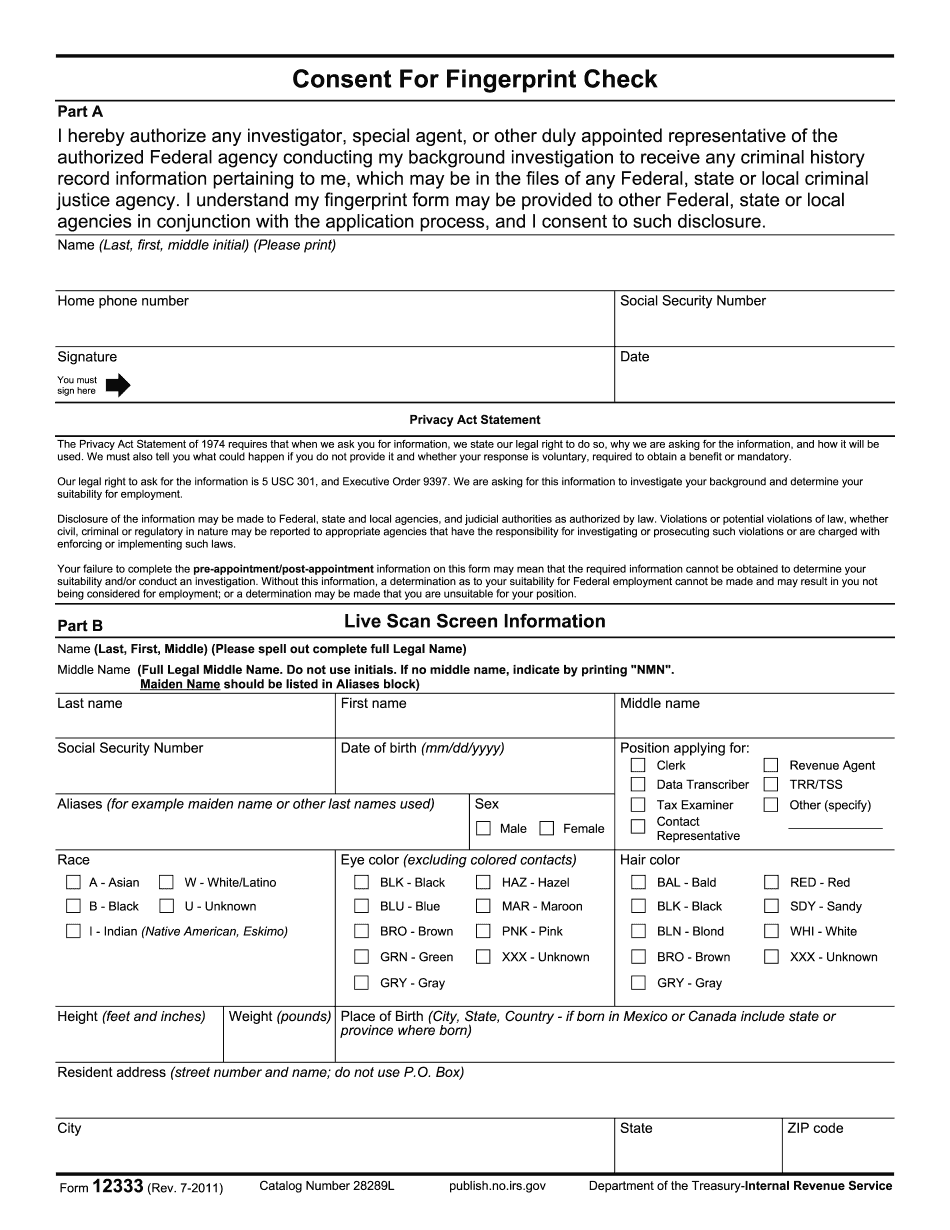

S. Department of Treasury. If used in connection with applications for security clearances, the form must be completed in conjunction with an application form for such Form SSA-4083 This form is intended to be used as a verification that the employee has performed the required duties for assignment to such assigned employment. This form should be completed by the employee and returned to the OPM, or, if the employee is under investigation for misconduct, filed electronically with EEOC (see “Employment Verification” on page 36 of Chapter 1 of Chapter 12 of this guide). Employment Verification (EEOC) or “verification of employment” as the term is commonly used by the IRS (see pages 31 & 46 of the IRS Publication 444), is the most critical portion of the process when receiving a letter from the IRS that has been received by the applicant in error or fraud. This process is the last opportunity to correct any error or fraud before a hearing scheduled by the IRS and/or an action to collect tax or correct the violation (usually within 30 days after the letter is filed or received.) The applicant may file for an IRS hearing within 30 days of the receipt of the letter in error when the employee has timely filed an EEO QA form and completed the EEO process or, if the employee is under investigation for misconduct, filed an EEOC form and completed the EEO process. The IRS will issue a Notice of Rehearing, which will indicate the appropriate agency or office in the country the employer is currently operating. Generally, the notice will require a hearing to occur within 45 calendar days of receipt from the EEOC service. This is followed by a letter that informs parties of the results of the hearing. In the case of a letter fraudulently prepared by the applicant, the tax return can be processed, but will require further investigation by a tax practitioner. In the case of an EEOC, the IRS may not be able to issue a notice of hearing, and, in that event, no further action will be taken. As an employer, and as an applicant, you must be familiar with how to use these forms.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12333 online Kentucky, keep away from glitches and furnish it inside a timely method:

How to complete a Form 12333 online Kentucky?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12333 online Kentucky aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12333 online Kentucky from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.