Award-winning PDF software

Rochester New York Form 12333: What You Should Know

The New York State Government's website has many useful tax information articles in different categories which include a link to New York State Form IT-201 (also called Form 11-1022). This form is a tax information statement (TIS) which must be filled and mailed to the state Department of Taxation and Finance (DT), the New York State Department of Labor, by an organization registered with New York State Department of Labor to provide the service to employees. The TIS must include all information in the TIS except information that the employee specifically requested should not be disclosed to the State and is confidential, privileged and exempt from disclosure under the law. You do not have to complete any paperwork if you have not already done so in the past due to a mistake or misunderstanding of the tax law requirements. The state Department of Taxation and Finance will use the information from your TIS to determine your filing obligation by adjusting the balance due to be paid in taxes. Please note that some taxpayers may have been issued a Form IT-200(EZ) by their employers for payment of federal, state or local income taxes or may have received a Form IT-201 or IT-202 for a state income tax. Both forms are electronic forms which are required to be completed and provided to the Department of Taxation and Finance. The form must be filed with your state employer. These versions of the forms vary in length from ten (10) pages to twenty (20) pages. Appeal Procedures In New York, tax appeals are handled in accordance with Tax Court Rules and Regulations. Tax Court rules and regulations may, depending on the facts, result in an immediate change of status of an individual or the imposition of some other administrative action. The decision of the Tax Court may be appealed to the Appellate Division for review with a hearing by an administrative law judge (ALJ). A party seeking a hearing must first send a written notice containing its request to the Tax Division, in writing within 10 days of the date of its receipt of the notice. The Tax Division must then send a written reply to the party, within 10 days of receiving the Party's request. The Tax Division, without holding a hearing, must decide whether the request was timely submitted and what appeal course to pursue. An appeal must be filed in the Tax Division within 45 days of the date of its decision.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Rochester New York Form 12333, keep away from glitches and furnish it inside a timely method:

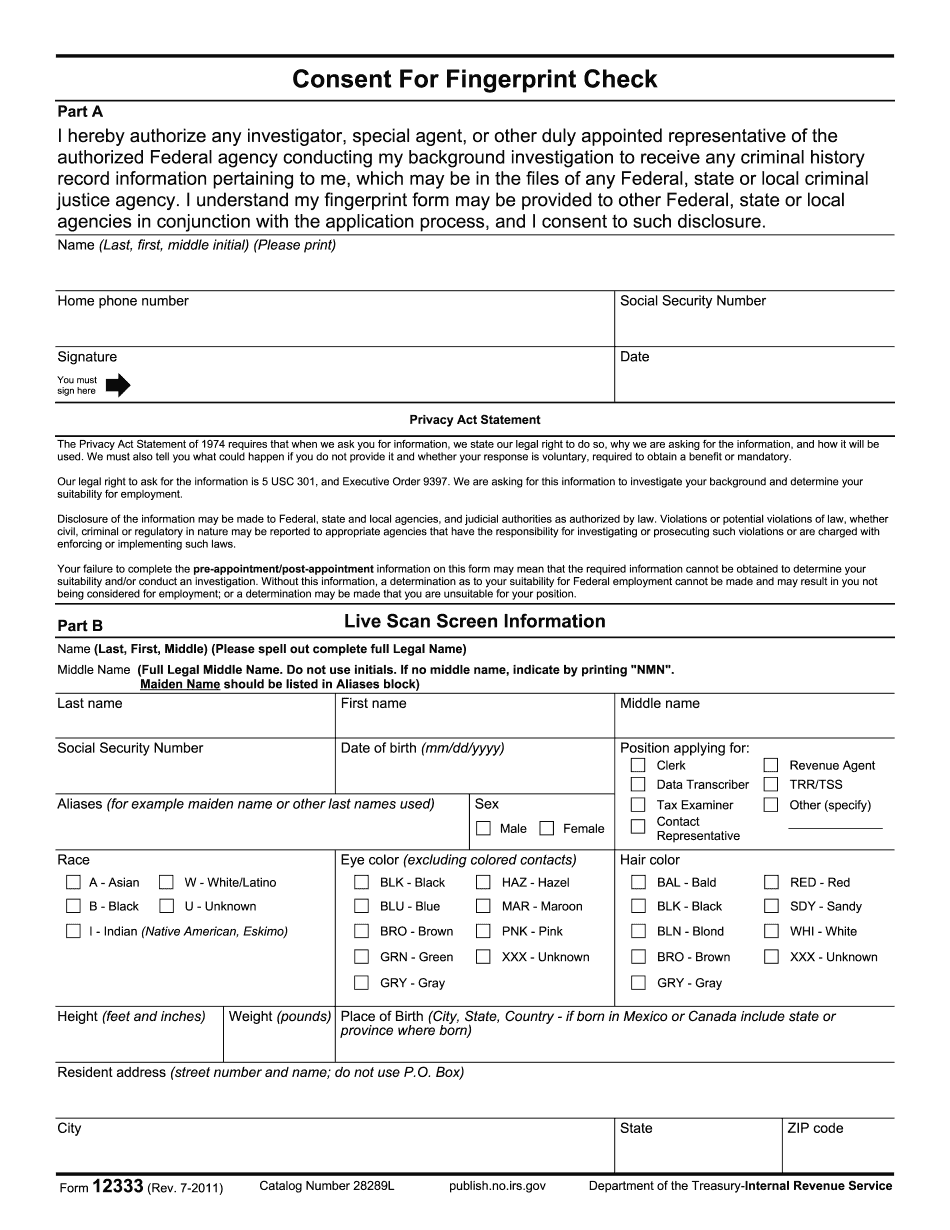

How to complete a Rochester New York Form 12333?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Rochester New York Form 12333 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Rochester New York Form 12333 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.