Award-winning PDF software

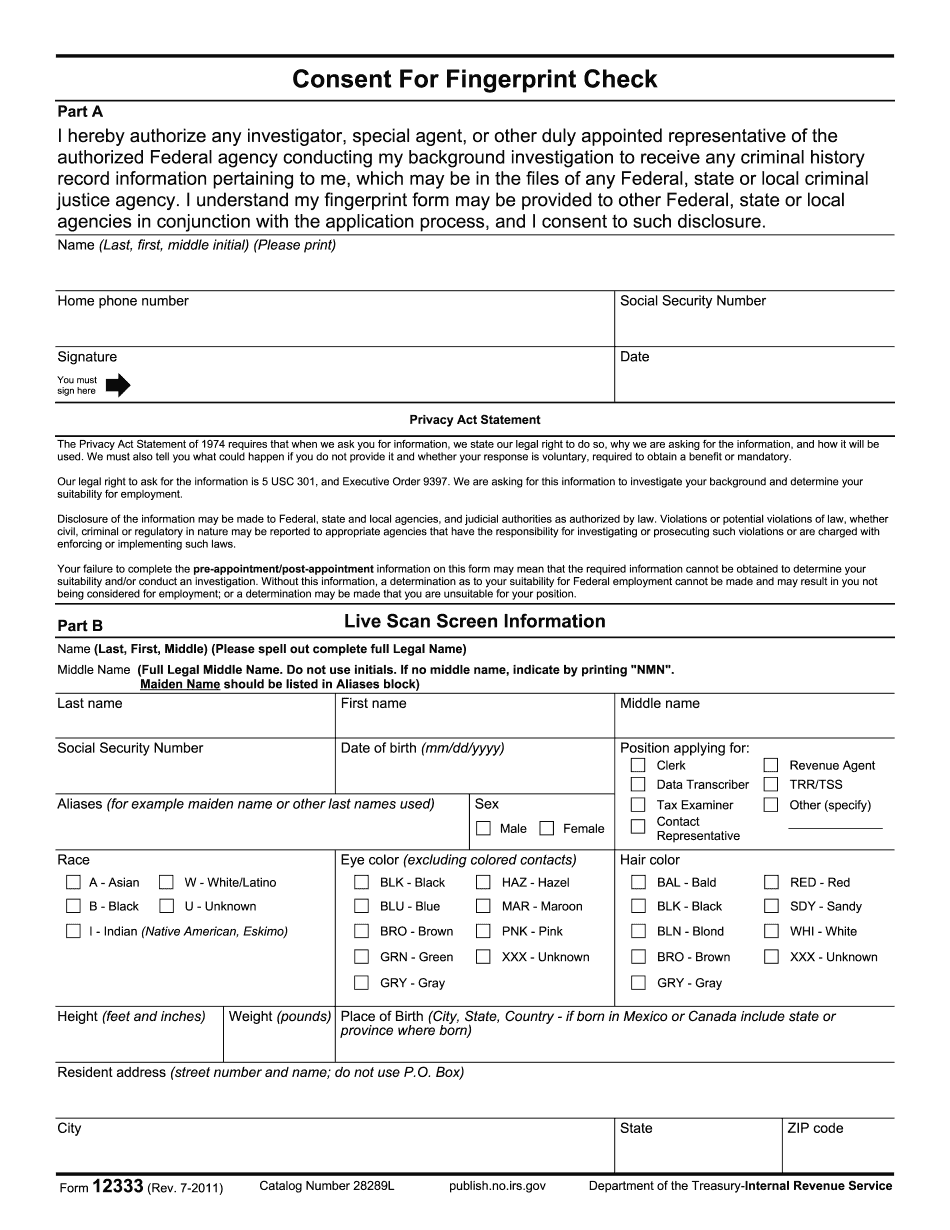

Printable Form 12333 San Jose California: What You Should Know

This must be received by the Tax Collector to be considered complete and accurate. A. The forms to be used and the date for them to be issued are attached in the above-noted order. B. The taxpayer must submit any application of the form with the required attachments and the appropriate tax proof (see section 1(c) below). C. The taxpayer will be required to sign the final Taxpayer Consent of Failure to Provide Identification Card form (C.R.S. 13-1115.02, Sec. 3.1) before the Form 12333 is sent. D. The Department will not process a request for an authorization to withhold on behalf of the City of San Jose without a completed Taxpayer Consent of Failure to Provide. Identification Card form (C.R.S. 13-1115.02, Sec. 3.1). E. In order to preserve the taxpayer's right to challenge and challenge and continue to fight this discriminatory practice, the taxpayer must retain his/her original Form 12333 and have all supporting documentation within ten (10) years from the date of its filing, unless the taxpayer provides in writing that he/she does not plan to retain his/her original Form 12333, and provides a clear explanation of why he/she does not, in writing before the Tax Collector's Office. F. The taxpayer may have their signature (or the signatures of two persons authorized on his/her behalf) accepted for Form 12333 if the taxpayer states that the signatures do not contain the taxpayer's or any other individual's unique fingerprint. For the taxpayer to submit a duplicate copy of his/her original Form 12333, the Tax Collector must receive the following in writing by the deadline for its submission: 1. The original Form 12333 signed by the taxpayer. 2. Documentation specifying which form received by the Tax Collector. 3. Documentation showing the taxpayer's signature on the duplicate Form 12333. G. If the taxpayer is having difficulties fulfilling any requirement listed on the form, the Tax Collector will notify him/her by letter not later than the next business day that further assistance is needed. The following are additional examples of other items and circumstances that would render an additional information request by the taxpayer invalid: 1. Failure to complete the required items (see section 1(e) below). 2.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 12333 San Jose California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 12333 San Jose California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 12333 San Jose California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 12333 San Jose California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.