Award-winning PDF software

Form 12333 online Fort Collins Colorado: What You Should Know

Some of these new rules are listed below, and they require the buyer to sign documents that allow the buyer to make the final agreement on the purchase in the event of a closing without performing a public appraisal. In the United States and many other jurisdictions, the use of the “t” character (and its abbreviation) when the last name begins with a U.S. hyphen has been adopted to denote the requirement for the final agreement to be made with the buyer and the seller with respect to each of the property. The U.S. Treasury Department's Tax Regulations section 1.6008-5(b) provides that “no final appraiser may sign an instrument or other agreement of purchase and sale relating to the property prior to completing and submitting an appraisal to the appraisal review board in connection with the sale of such property.” This provision was implemented by § 1.6008-5(a) of the Tax Regulations. Example Mar 17, 2024 — § 1.608(b) In general, tax law, including the procedures for the final appraisal, applies to real properties in which a sale is not completed unless: A contract of sale exists or is entered into. A final appraisal is conducted. The final appraisal must be conducted by an accredited appraiser outside the transaction. The contract or the contract of sale must clearly set forth the procedures for the valuation of the property or other property to be purchased or any services to be performed, any fees or costs to be borne by the taxpayer, and the time and place for the completion of the transaction. The contract does not include a reference to a public sale except the phrase “[p]lease be subject to a public sale.” (E. 2) Example July 10, 2013– § 50.104(a) Where the actual receipt of the taxable property to an owner was the result of a public sale and notice of the public sale is provided in a manner reasonably calculated to inform the public to the fact that the property is subject to a taxable sale, the actual receipt of the property to that person in a transaction to which section 50.104 applies is deemed to have occurred on the date and at the time the notice is given.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 12333 online Fort Collins Colorado, keep away from glitches and furnish it inside a timely method:

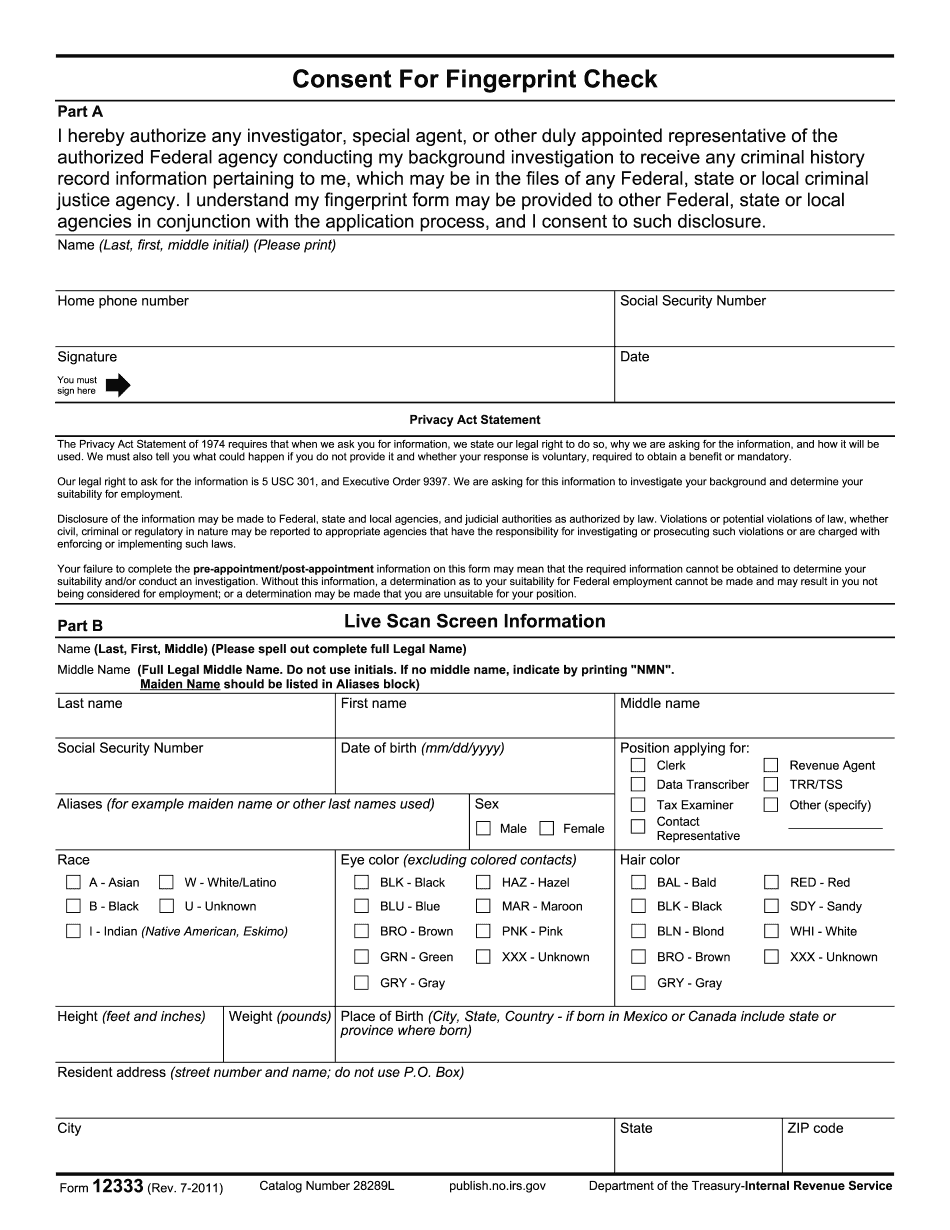

How to complete a Form 12333 online Fort Collins Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 12333 online Fort Collins Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 12333 online Fort Collins Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.