Award-winning PDF software

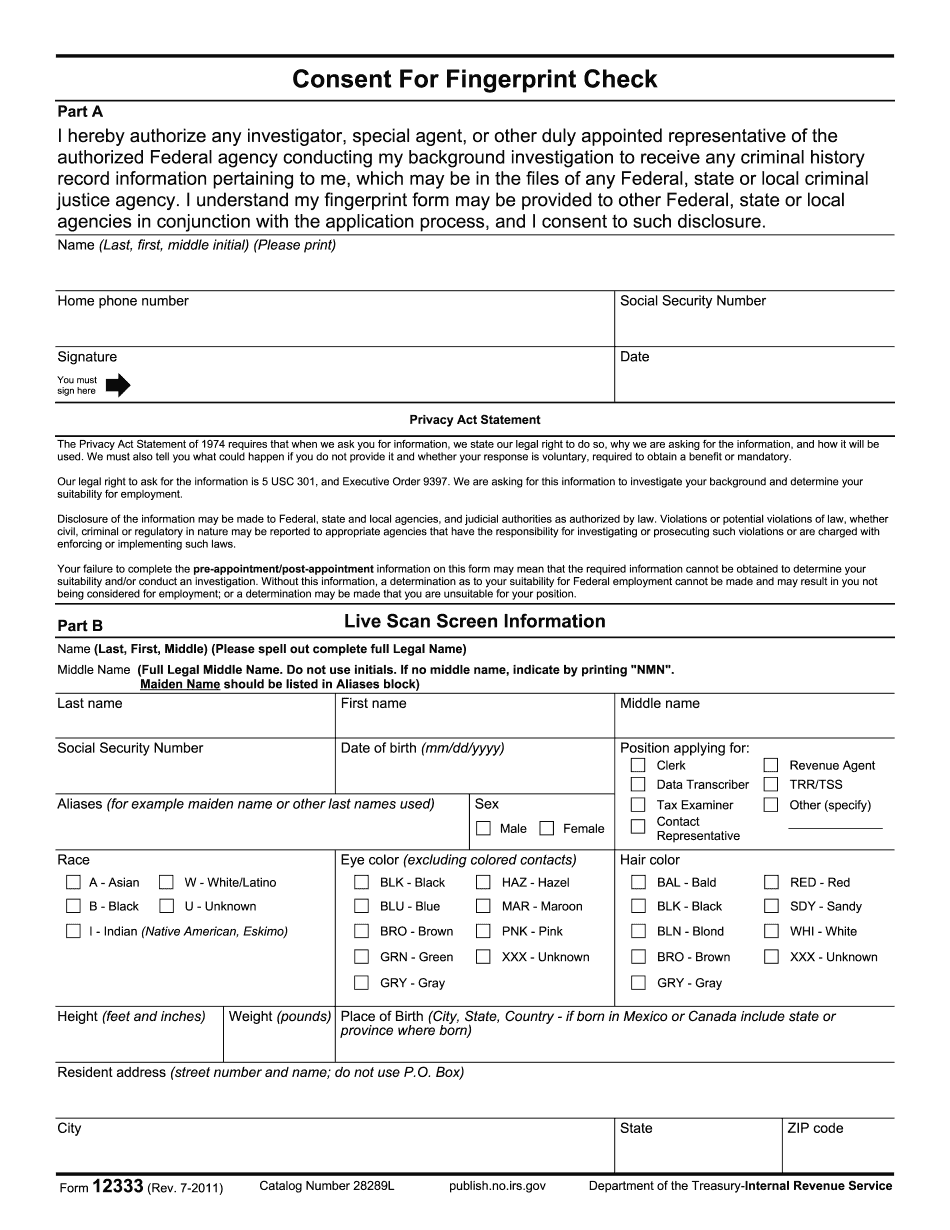

Elgin Illinois Form 12333: What You Should Know

They are open to the public. Forms | City of Elgin, Illinois -- Official Website You're probably wondering ... What is a form? A form is a page on your computer or smartphone with instructions and instructions that tell you how to complete a specific, single task. Fingerprints Offenders If I were to ask you what is the most important factor to remember when it comes to paying your property taxes ... 1. Paying your Property Taxes as soon as your payments are due! 2. Paying your Property Taxes as soon as you receive your State of Illinois Assessors Valuation Report from the local assessors office — that gives you the Property Tax Assessors Guide that is required before you send in your monthly property taxes or pay your assessments in full. There are several forms available from the City of Elgin that allow the property tax administrator to report your current and future payments. Forms & Publications | City of Elgin, Illinois — Official Website The City of Elgin publishes the annual State of Illinois Assessment Book and Form, and offers the following forms: Form 13, Annual City Of Elgin Tax Assessor's Tax (Property); Form 37, County Of Cook (City of Chicago) Tax Assessor's Tax (Real Property); Form 42, Champaign County Assessor's Tax (Property); Form 13R, County Of Dupage (City Of Rockford) Tax Assessor's Tax (Real Property); Form 44, Henderson County Tax Assessor's (Real Property); and Form 12, Assessors Property Assessment/Real Property (Property). The City issues these forms and offers these registration services for property registration when an applicant submits both their tax application and their State of Illinois Assessors Valuation Report to the Department of Revenue (the local office) which is located at 75 W Oak St., Elgin, Illinois 60514. The City of Elgin assesses and collects the following taxes on real property: Property tax — Tax rates from 0.05 per 100.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Elgin Illinois Form 12333, keep away from glitches and furnish it inside a timely method:

How to complete a Elgin Illinois Form 12333?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Elgin Illinois Form 12333 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Elgin Illinois Form 12333 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.