This video explains how easy it is to roll your own fingerprints. You received your package from Fast Fingerprints. Next, you will empty the contents. There should be two FD 258 fingerprint cards, instructions, ink strips, and a pen. You may wish to practice rolling each finger to know how to do it correctly. See the back of the card for an example of a rolled fingerprint. When you are ready, please place the cards in front of you and fill out the top. Now, you will take one of the ink strips and peel off the top layer to expose the ink. Please be careful not to get any ink on your clothes. Let's start with your right hand. Place the ink strip on the right side of the card. When rolling your fingerprints, make sure to get a full roll from one side of the finger to the other on the inking strip. It will help to work from the top of the card to the bottom. Finish each roll before moving on to the next finger on the card. Starting with your right thumb, roll from the nail bed to the other side. Continue to roll each finger one after the other in the correctly labeled sections. For example, our index finger is your right index finger. You will continue the second row with your left hand. Follow the same instructions as in the previous steps. Ink the fingers once again. To do the last row, place your left four fingers flat and at a slight angle on the card where it says "left four fingers taken simultaneously." Place your left thumb flat and straight on the card where it says "L thumb." Place your right thumb flat and straight on the card where it says "our thumb." Lastly,...

Award-winning PDF software

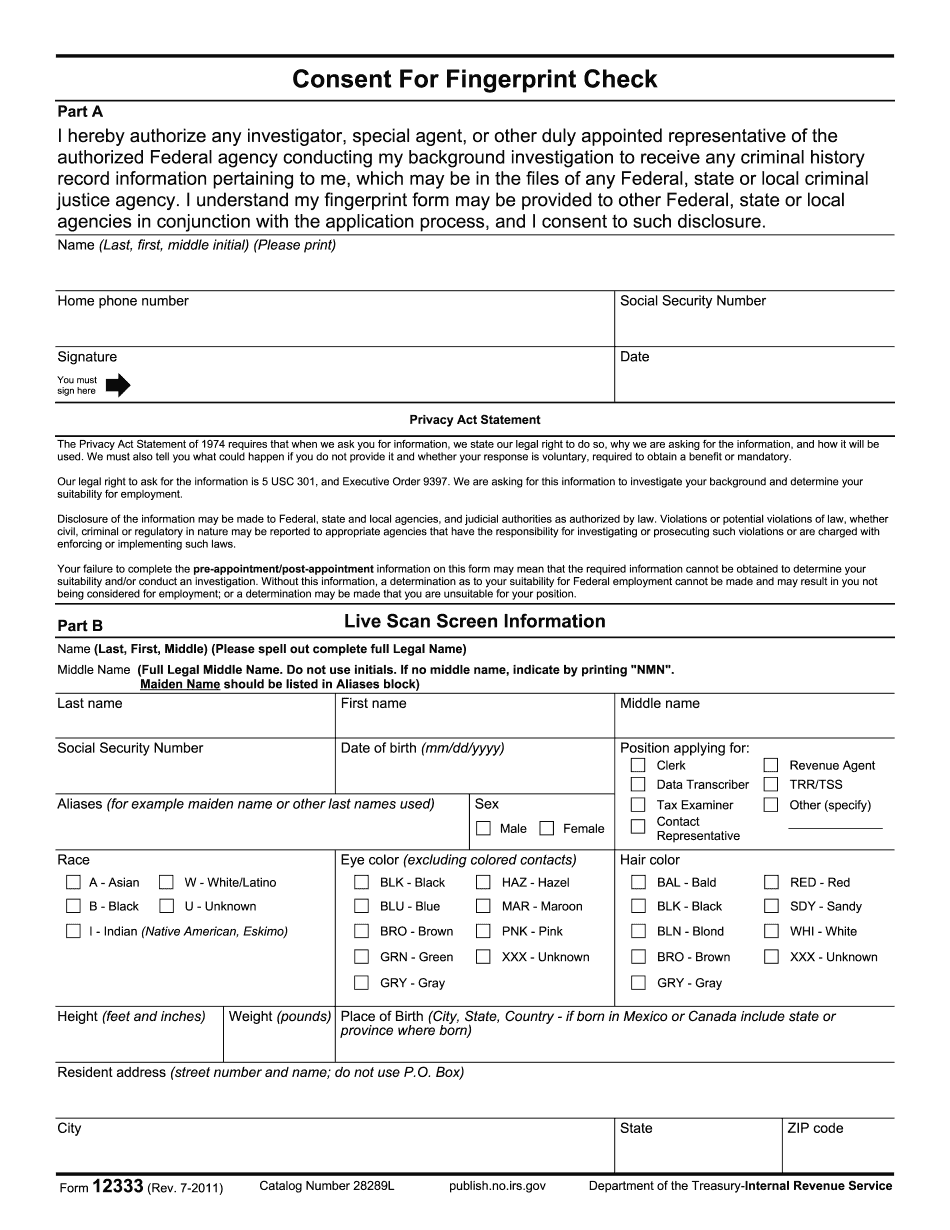

Irs fingerprint card Form: What You Should Know

Submissions are now Final for Tax-Exempt Status — IRS Jul 17, 2024 — E-Postcards are no longer accepted for the annual small reporting requirement in the 2024 tax year. An e-Postcard is considered to be a paper tax return, even if the form includes a signature card. Any e-Postcards that you have placed into your e-Postcard system will not be accepted for future tax return filers. E-Postcards can still be used for a paper IRS tax return submission on an occasion when you receive a return from a small organization and would like to complete the entire tax return using an e-Postcard. If that circumstance arises in the future, simply return your e-Postcard for a refund. How do I file a joint return, with a spouse or with a person under age 16 on my 2024 Federal Income Tax Return Mar 08, 2024 — If your taxpayer's gross income does not meet the tax-exempt organization definition, you cannot fill out a joint federal income tax return with other people: If there is no taxpayer or taxpayer spouse in the tax-exempt organization tax code or who is under age 16, there are two options: Submit Form 1040 or 1040A, together with Form 951, the jointly filed federal income tax return for two taxpayers. Fill out Form 972, “Paid Under Age 17 and Claiming a Qualifying Spouse or Child” using a return preparer or a tax agency and submit it together with another Form 972. Use Form 952, “Paid Under Age 17 and Claiming a Qualifying Parent or Child” or Form 957, “Child of Parent Claiming A Qualifying Spouse Or Child.” Form 4976 (Form 2106, the “Wages and Self-Employment Income Tax Return”) and Form 709, “Social Security and Medicare Tax Return,” must be used when filing a joint return. Use Form 5498 to file Form 4976, as an attachment to Form 2106. Use Form 4797 or Form 8949 for Form 709. If the return includes a Form 1320-F, a Form 8949, or a Form 4797, these taxes are not includible by the gross income limit set forth in the “Income Tax with Respect to Wages and Self-Employment Income” table in the Schedule A instruction (see instructions on Form 4457).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 12333, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 12333 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 12333 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 12333 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs fingerprint card