Hi guys, I'm Jonathan Meese from answers.com, your top source for silencers online. In this video today, we'll be going over the proper way to fill out a fingerprint card for NFA purchases. As many of you are probably aware, as of July 13th, 2016, the process for purchasing suppressors and other NFA items has changed. These changes include the requirement for all applications, including individuals and trusts, to accompany two sets of fingerprint cards per item per person. This can be a daunting task, especially if you live in an area that doesn't offer this service. The good news is that the ATF does not require you to have your fingerprints done at a police agency or an independent contractor. While there are perks to utilizing these places, you can do them yourself if you have the right equipment. The ATF states that whoever is doing them should be properly equipped. So, what makes you properly equipped? In order to be properly equipped, you should have the official Blue Lightning FD-258 fingerprint cards. You can get these for free at any class 3 dealer or through us. You will also need a fishel black ink fingerprint pad. The one we use is the EZ print EP 15. You can purchase these online or through us on our website. Some other options that would help you are a fingerprint card holder, which you can also purchase or lease through us on our website. Some other things to have are baby wipes to clean your hands and re-tabs in case you mess up on the block. However, be aware that you're only allowed to use purple on your station. Your station should be free of clutter, with plenty of space, and be around 3 to 3 and a half feet off...

Award-winning PDF software

Irs fingerprinting locations Form: What You Should Know

Com application. IRS e-services account for all taxpayers provides a secure, easy way to receive and process your tax payments electronically, IRS e-services application for IRS e-file | Forms and Publications IRS e-file | IRS e-file for file When you complete an online tax return submission or enter data electronically, your income may be electronically entered with the income- and refundable and nonrefundable credits, credits, adjustments and exemptions. In many instances, the electronic payment process may be faster than mailing a paper payment; however, electronic funds transfers may take up to 5 business days. You may submit your return at any time through the IRS e-service portal to the “Taxpayer Service Center” (TSC), using the “Print My Tax Return” tool, on IRS.gov or at local TSC offices.

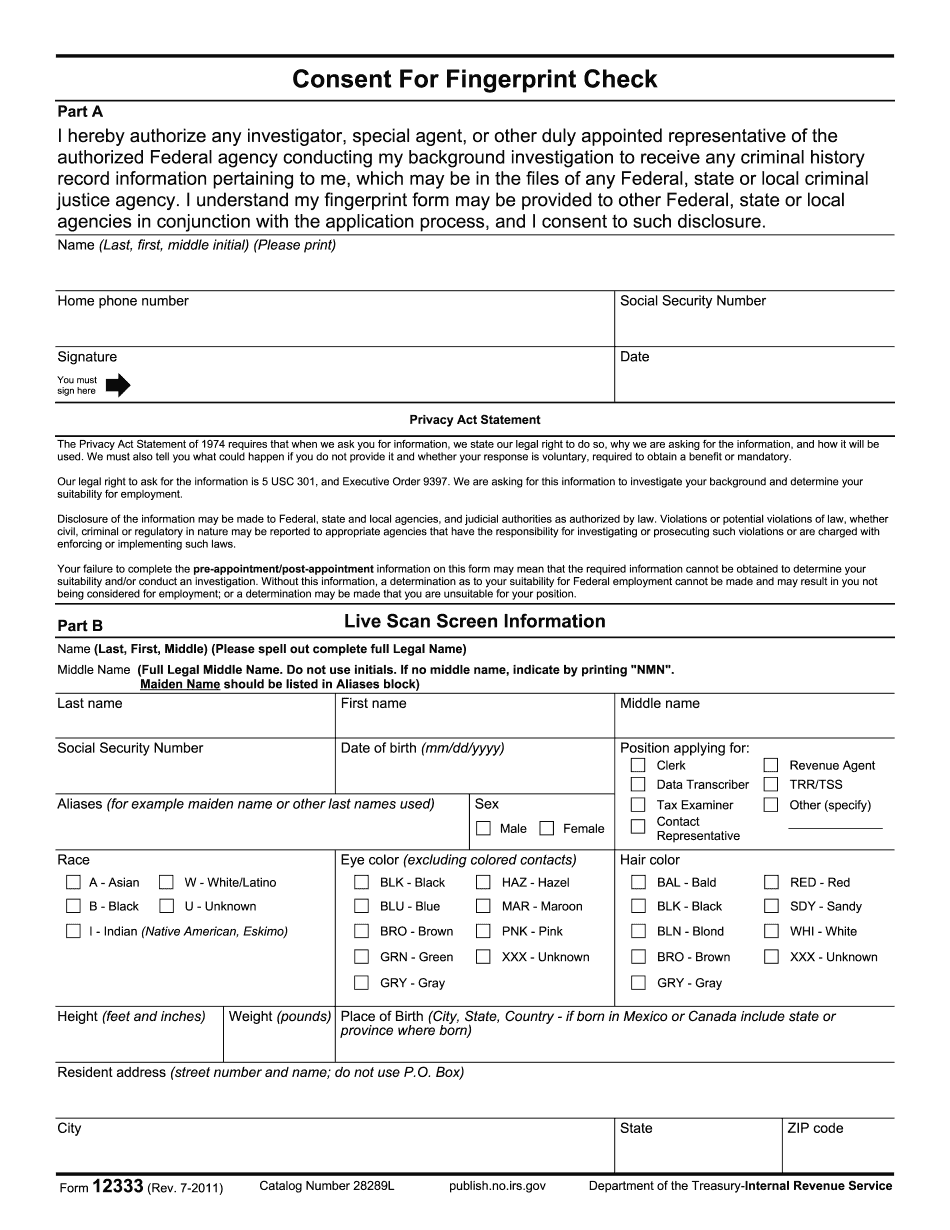

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 12333, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 12333 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 12333 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 12333 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs fingerprinting locations